Avoiding Legal Pitfalls in Vendor Agreements

August 15, 2025

Share Article:

Settling disputes with our online arbitration services is easy, fast, and affordable.

We look forward to answering your questions and helping you to reach conflict resolution with our online arbitration service.

I hear the same story from business owners all the time. A contractor in Florida signs a job, everything seems smooth, and then suddenly a disagreement over the contract terms pops up. Nobody wants to go to court, and most people do not want the costly

A binding decision is a ruling made by a neutral third party, such as a judge, arbitrator, or administrative body, that the parties involved must follow. In legal terms, it has the same weight as a court order. Unlike casual agreements or negotiations, a binding

Preventing Lawsuits in Joint Venture Agreements

Joint ventures (JVs) can be powerful tools for growth. Two businesses combine expertise, share resources, and expand into new markets. But for every successful real estate joint venture or international expansion, there are countless stories of deals falling apart

Arbitration Guide for Corporate Counsel and In-House Teams

For corporate counsel and in-house counsel, arbitration is no longer just an “alternative” to litigation, it’s a standard part of managing business disputes. Whether in technology, finance, real estate, or construction projects, companies increasingly rely on arbitration

Arbitration vs Mediation vs Litigation: Key Legal Differences

Imagine you’re a business owner in South Carolina who suddenly finds yourself in a heated dispute with a supplier. Do you head straight to the courthouse? Sit down with a mediator? Or let an arbitrator decide the outcome? These three pathways , arbitration,

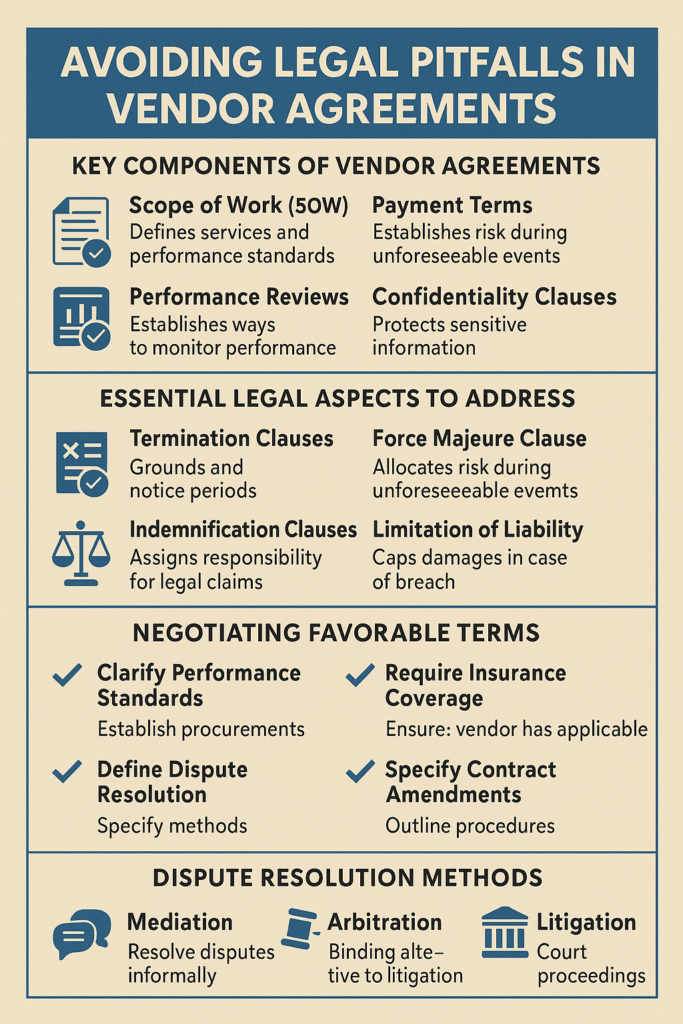

Strong vendor agreements form the foundation of successful business transactions. Whether you run a healthcare practice, an Ambulatory Surgery Center, or a fast-growing e-commerce operation, contracts with third-party vendors dictate performance standards, delivery timelines, payment terms, and dispute resolution processes. Yet many businesses overlook critical legal aspects of these agreements, which can lead to costly disputes, supply chain issues, and even regulatory penalties. By understanding the essential elements of vendor contracts, you can avoid legal troubles and protect your business relationships.

Key Components of Vendor Agreements

Every vendor contract should include clear descriptions of goods and services, performance metrics, and delivery timelines. Ambiguity in contract language often leads to waste or breach when expectations are not met. Essential elements include:

- Scope of Work (SOW): Defines the specific services, deliverables, and performance standards expected from the vendor.

- Payment Terms: Outlines pricing and/or quantity terms, due dates, interest for late payments, and acceptable payment methods.

- Performance Reviews: Establishes how vendor performance will be monitored through reports, metrics, or audits.

- Confidentiality Clauses: Protects confidential business information, trade secrets, and intellectual property shared with vendors.

Well-drafted vendor contracts reduce the risk of conflict and provide both parties with a reliable framework for managing expectations.

Essential Legal Aspects to Address

Vendor agreements are legally binding contracts. Ignoring the legal implications of poorly drafted agreements can expose businesses to significant risk. Common legal aspects include:

- Termination Clauses: Contracts should clearly state conditions for termination for cause, no-cause termination, and notice periods.

- Force Majeure Clause: Protects both parties in the event of unforeseeable events such as natural disasters, pandemics, or geopolitical disruptions.

- Indemnification Clauses: Allocates responsibility if legal claims arise from vendor performance or product liability.

- Limitation of Liability: Caps financial exposure in the event of contract breach or damages.

For specialized industries such as healthcare, vendor agreements must also comply with federal regulations like the Anti-Kickback Statute, Stark Law, and HIPAA compliance for data privacy.

Recognizing Potential Pitfalls in Vendor Contracts

Even carefully negotiated vendor agreements can contain hidden pitfalls. Issues commonly arise when:

- Payment terms are vague, leading to disputes about reimbursement rates or late fees.

- Intellectual property ownership is not addressed, creating conflict over content ownership and data and content rights.

- Confidentiality clauses lack specificity, risking breaches of trade secrets or data security.

- Renewal provisions are not defined, leading to automatic renewals at unfavorable terms.

- Vendor performance standards are too general, making enforcement difficult.

A contract review process conducted by experienced legal counsel helps identify and correct these vulnerabilities before signing.

Negotiating Favorable Terms

Negotiating a vendor agreement requires balancing business terms with legal protections. Businesses should:

- Clarify performance standards and service level agreements (SLAs).

- Require insurance coverage and proof of compliance with state regulations.

- Define dispute resolution clauses, including mediation or arbitration, before litigation.

- Specify contract amendments and renewal provisions to allow flexibility in long-term vendor relationships.

Effective negotiation also involves leveraging procurement software or contract management systems like DocuSign CLM to streamline contract drafting, approvals, and storage in a central contract repository.

Dispute Resolution and Conflict Prevention

No business relationship is immune to conflict. Including robust dispute resolution provisions in vendor agreements helps prevent small disagreements from escalating into expensive litigation. Common methods include:

- Mediation: A neutral mediator helps resolve disputes informally.

- Arbitration: A binding process that is faster than traditional court proceedings.

- Litigation: Necessary only when other dispute resolution processes fail.

Having a dispute escalation plan in place ensures that issues such as supply chain disruptions, customer service failures, or non-payment disputes can be addressed promptly.

Vendor Vetting and Selection Process

The best vendor agreements begin long before contract drafting. A strong vendor vetting workflow includes:

- Reviewing vendor performance history and customer service track record.

- Verifying compliance with federal and state regulations, such as Georgia record retention requirements for medical records.

- Conducting due diligence on financial stability to prevent disruptions from vendor insolvency.

- Confirming data security practices align with GDPR and CCPA for data privacy laws.

By carefully selecting third-party vendors, businesses reduce the risk of legal issues and strengthen long-term vendor relationships.

The Role of Legal Counsel in Vendor Agreements

Attorney review of vendor contracts is not just advisable, it is often essential. Legal counsel ensures that:

- Contractual obligations are clearly defined.

- Termination for cause and indemnification language protect your interests.

- Prevailing party fees, attorney’s fees clause, and risk of loss are fairly allocated.

- All contract provisions comply with state regulations and industry-specific federal regulations.

Investing in legal advice at the start of a vendor relationship can save thousands in legal costs later.

Maintaining Strong Vendor Relationships

Avoiding legal pitfalls is not only about drafting airtight contracts. Long-term success requires ongoing vendor management:

- Conducting regular performance reviews and contract renegotiation when necessary.

- Tracking obligations through a contract management system or repository.

- Maintaining open communication with vendors to address issues early.

- Preparing contract amendments when business terms or pricing structures change.

Strong vendor relationships reduce the likelihood of disputes, foster mutual trust, and create a framework for growth in the business world.

Final Thoughts

Vendor agreements are more than paperwork, they are risk management tools that protect businesses from liability, compliance failures, and financial loss. By carefully drafting vendor contracts, clarifying payment terms and delivery timelines, and embedding dispute resolution clauses, businesses can minimize legal pitfalls. Whether you are negotiating with medical supply vendors, insurance payors, or technology providers, the combination of legal resources, proper contract drafting, and proactive vendor management ensures smoother operations and healthier business relationships.

Recent Posts

I hear the same story from business owners all the time. A contractor in Florida signs a job, everything seems smooth, and then suddenly a disagreement over the contract terms pops up. Nobody wants to go to court, and most people do not want the costly

A binding decision is a ruling made by a neutral third party, such as a judge, arbitrator, or administrative body, that the parties involved must follow. In legal terms, it has the same weight as a court order. Unlike casual agreements or negotiations, a binding

Preventing Lawsuits in Joint Venture Agreements

Joint ventures (JVs) can be powerful tools for growth. Two businesses combine expertise, share resources, and expand into new markets. But for every successful real estate joint venture or international expansion, there are countless stories of deals falling apart

Arbitration Guide for Corporate Counsel and In-House Teams

For corporate counsel and in-house counsel, arbitration is no longer just an “alternative” to litigation, it’s a standard part of managing business disputes. Whether in technology, finance, real estate, or construction projects, companies increasingly rely on arbitration

Arbitration vs Mediation vs Litigation: Key Legal Differences

Imagine you’re a business owner in South Carolina who suddenly finds yourself in a heated dispute with a supplier. Do you head straight to the courthouse? Sit down with a mediator? Or let an arbitrator decide the outcome? These three pathways , arbitration,